The U.S. car market is downshifting. The resilience that began with the collapse of the banking sector persisted for several months, but now its momentum is diminishing. Last summer, average car prices hit a record high. There was also oversupply. A combination of these factors is the reason why prices are currently falling.

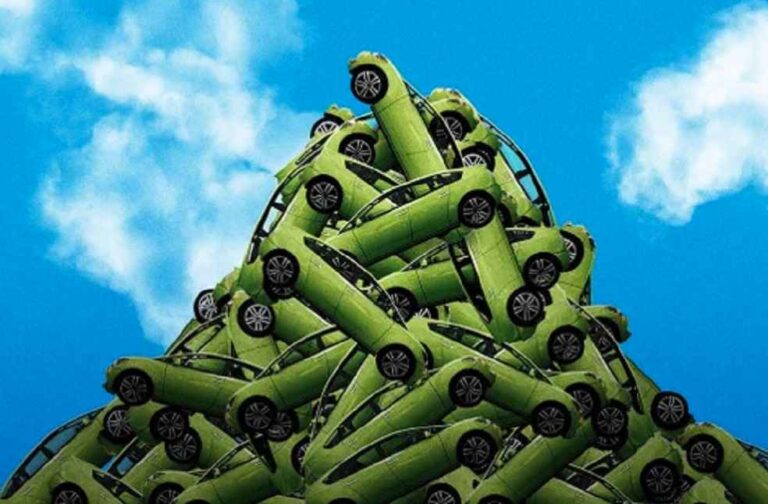

A study released by UBS suggests that car production worldwide will outstrip sales by a margin of 6% this year. This could result in a surplus of roughly 5 million vehicles, necessitating major price reductions to encourage sales, as Yahoo Finance reports.

UBS shares insights in a note to clients, indicating that a pricing battle has already commenced within the EV sector. The firm predicts this trend will seep into the combustion engine sector during the second half of 2023. The cause for this shift primarily lies in bullish production schedules leading to potential excessive manufacturing and subsequent pricing pressure.

Producers of family cars could experience the harshest effects of these price reductions, according to analysts. Conversely, producers of luxury vehicles are expected to withstand the pressure relatively unscathed.

Electric vehicle manufacturers, also facing this significant blow in the market. As a testament earlier this year, Tesla, Elon Musk’s electric vehicle company, preempted this situation, implementing a reduction of up to £8,000 on their UK car prices. This change situates some of Tesla’s lower-cost models in the same price bracket as mass-market brands such as Kia.

Other car manufacturers are adapting to this trend, with Ford Motor Company and Lucid lowering their own EV prices in response to Tesla’s initiative, as indicated by Proactive Investors.

Concurrently, recent data illustrates a slight relaxation in car prices across all segments. Statistics from Cox Automotive show a 2.4% reduction in wholesale used-vehicle prices in March compared to last year, despite witnessing a modest 1.5% rise from the previous month.

A March 23 report from Kelley Blue Book denotes a sequential drop in new vehicle prices for three consecutive months. This pattern is emerging as a persistent trend. Yet, even with these price reductions, they continue to hover at historically high levels.

With the impending price war, potential buyers could reap benefits from the looming oversupply. Car manufacturers, on the other hand, will be tasked with maneuvering through the complexities of pricing strategy amid a rapidly transforming market.