US President Donald Trump has announced a 25% tariff on imported cars and light trucks, set to take effect next week, in a move expected to increase vehicle prices and disrupt automotive production. The decision marks a significant escalation in the global trade tensions reignited since Trump’s return to the White House earlier this year.

“What we’re going to be doing is a 25% tariff for all cars that are not made in the United States,” Trump said during an Oval Office event, positioning the measure as part of his broader strategy to revive domestic manufacturing and offset revenue lost through tax cuts.

The tariffs, scheduled to begin on April 3, follow the president’s plan to introduce reciprocal duties targeting nations contributing most to the U.S. trade deficit. Industry experts warn that the new tariffs could have a substantial economic impact, particularly as the U.S. imported $474 billion in automotive products in 2024, including $220 billion in passenger vehicles. Major exporters to the U.S. include Mexico, Japan, South Korea, Canada, and Germany.

Reactions from global leaders were swift. European Commission President Ursula von der Leyen criticised the move as “bad for businesses, worse for consumers,” while Canadian Prime Minister Mark Carney denounced it as a “direct attack” on Canadian workers.

“We will defend our workers, we will defend our companies, we will defend our country, and we will defend it together,” Carney said.

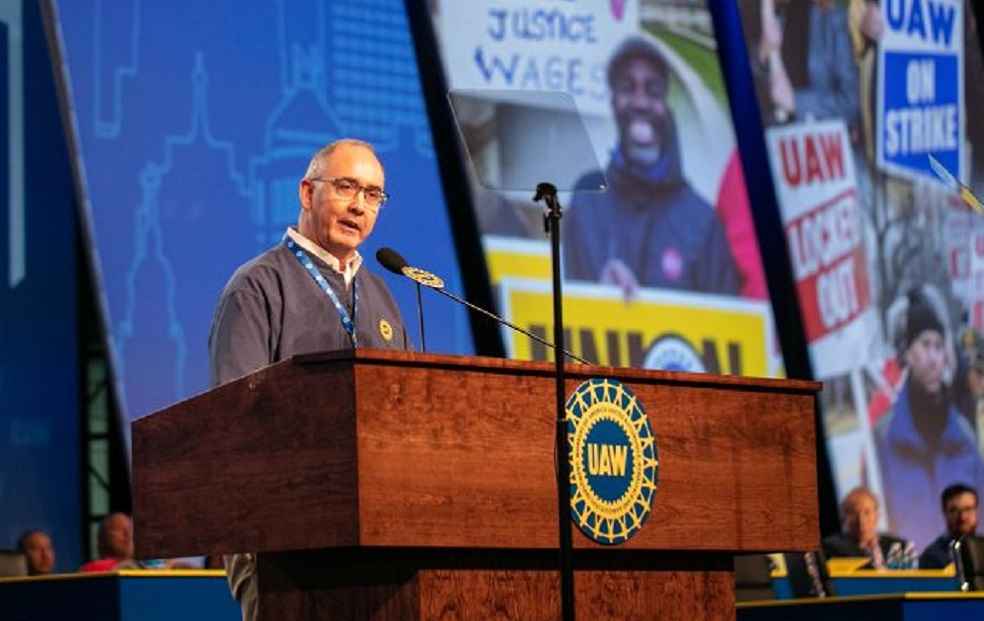

The United Auto Workers (UAW), however, welcomed the decision. “These tariffs are a major step in the right direction for autoworkers and blue-collar communities across the country,” said UAW President Shawn Fain, urging automakers to reinvest in union jobs across the U.S.

The White House said the legal foundation for the action stems from a 2019 investigation under Section 232 of the Trade Act of 1962, which found that auto imports threatened national security. Though no action was taken at that time, the findings are now being used to justify the new tariffs.

Notably, Trump’s directive includes temporary exemptions for auto parts, particularly those compliant with the U.S.-Mexico-Canada Agreement (USMCA), negotiated during his first term. These components will remain tariff-free until the Department of Commerce finalises procedures for assessing duties on their non-U.S. content. All other auto parts are exempt until May 3.

Harrison Fields, principal deputy press secretary, confirmed the exemptions, stating that USMCA-compliant parts will avoid tariffs until further guidance is issued.

Despite these carve-outs, analysts predict wide-ranging consequences. Brad Setser of the Council on Foreign Relations warned that tariffs on around 4 million cars imported from Canada and Mexico would raise prices and suppress U.S. vehicle sales. He also flagged potential violations of existing trade agreements, including USMCA and the U.S.–South Korea pact.

The market responded negatively. Shares of automakers dropped in after-hours trading, and U.S. equity futures indicated a weaker opening. Tesla CEO Elon Musk said the tariffs would not spare his company entirely. “The tariff impact on Tesla is still significant,” he wrote on X.

The S&P 500 Index dropped 1.1% ahead of Trump’s press conference and has fallen over 4% this month, marking its worst monthly performance in nearly a year. Investor sentiment has been shaken by uncertainty over trade policy, compounded by repeated threats and reversals from the White House.

Since returning to office on January 20, Trump has unveiled a series of tariffs, including on Canada and Mexico over fentanyl-related concerns, as well as duties on Chinese imports and metals. He has promised a broader set of global reciprocal tariffs to be detailed on April 2, though he hinted these might be more lenient than expected.

“We’re going to make it very lenient,” Trump said. “I think people will be very surprised. It’ll be, in many cases, less than the tariff they’ve been charging the U.S. for decades.”

Industry groups warn that the current tariffs could harm consumers and domestic jobs. The Center for Automotive Research noted that prices of new vehicles could rise by thousands of dollars. Jennifer Safavian, CEO of Autos Drive America, said the decision would reduce affordability and job opportunities.

“These tariffs will make it more expensive to produce and sell cars in the United States,” Safavian said, “ultimately leading to higher prices, fewer options for consumers, and fewer manufacturing jobs in the U.S.”

GENERAL | BYD Plans 800,000 Overseas Sales in 2025, Expands Global Factory Footprint