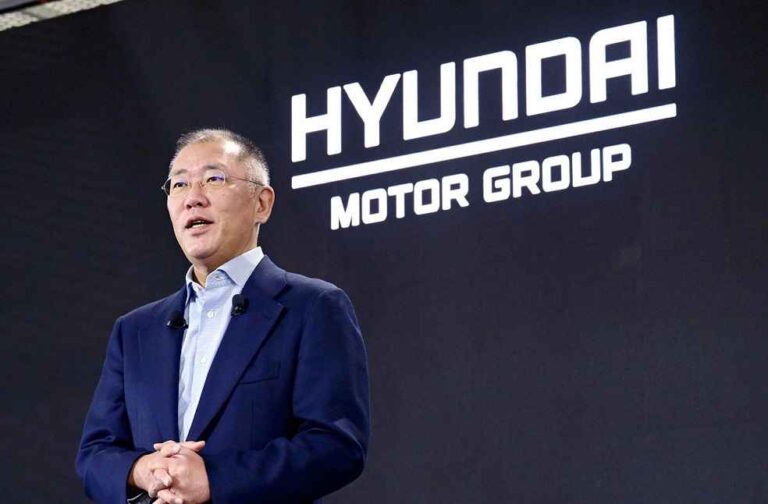

Hyundai Motor Group Executive Chair Euisun Chung marks his fifth year in leadership, having transformed the South Korean automaker into one of the world’s top three carmakers while driving a bold transition toward electrification and future mobility.

Since assuming the role in October 2020, Chung has redefined Hyundai’s growth strategy, steering the group beyond traditional internal combustion engines into software-driven mobility, hydrogen, robotics, and advanced air transport.

Under his leadership, Hyundai Motor Group rose from fifth place in global sales to the top three in 2022 and has maintained that position since.

In the first half of 2025, it recorded a combined operating profit of over 13 trillion won ($9.11 billion), surpassing Germany’s Volkswagen Group to become the world’s second most profitable automaker.

Hyundai’s quality standards have also improved significantly. The company has topped U.S. market researcher J.D. Power’s Initial Quality Study for two consecutive years, a major turnaround from its earlier reputation challenges.

The group has collected more than 25 global awards in key markets, strengthening its technological credibility and brand appeal.

“Euisun Chung abandoned the internal combustion playbook and boldly reshaped the group into a software- and electrification-driven enterprise,” said Lee Hang-ku of the Korea Automotive Technology Institute.

“Among global automakers, he has moved most swiftly to establish a framework for the mobility transition.”

Major challenges remain. The 25% U.S. import tariff continues to weigh heavily on profitability. Although Seoul and Washington agreed in July to reduce the rate to 15%, implementation has stalled, while Japanese and European automakers have already secured tariff cuts.

FnGuide projects Hyundai and Kia’s combined third-quarter operating profit at 5.08 trillion won, down 21.4% year-on-year, with the tariff burden alone estimated at 1.5 trillion won for Hyundai and 1.23 trillion won for Kia.

Hyundai’s push to mitigate tariff exposure through U.S.-based production has encountered setbacks. According to The Wall Street Journal, three workers have died since construction began in 2022 at Hyundai’s $7.6 billion EV and battery plant in Georgia, an unusually high fatality rate for a project of that scale.

The report also highlighted a U.S. Immigration and Customs Enforcement (ICE) raid last month that detained over 300 Korean workers on visa-related violations.

Meanwhile, Chinese electric vehicle makers such as BYD, Geely, and XPeng are rapidly expanding their global presence with cost-efficient production and advanced battery technologies. Analysts warn that Hyundai must now fortify its brand premium and software ecosystem to sustain its lead.

“Hyundai may be leading the global shift to electrification, but fierce competition with Chinese automakers lies ahead,” said Cho Chuel of the Korea Institute for Industrial Economics and Trade. “Enhancing software and service competitiveness will be Chung’s next major challenge.”

EV WORLD | MAA Urges Malaysia to Extend EV Tax Exemptions Beyond 2025