A recent surge in copper prices to a ten-year high poses a significant challenge for the U.S. automotive industry, particularly for electric vehicle (EV) production, as copper is a vital component. The price increase threatens to raise production costs, potentially leading to higher car prices and dampened consumer demand.

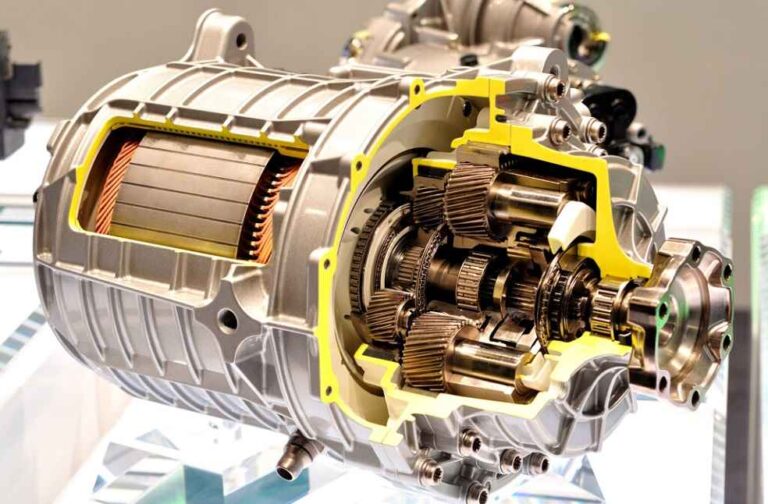

One of the main drivers of increased copper consumption is the growing demand for EVs, which require significantly more copper than traditional internal combustion engine vehicles. As the EV market expands, copper demand is expected to rise further, potentially exacerbating price pressures.

To mitigate the impact of rising copper prices, automakers are exploring various strategies:

- Substitute Materials: Manufacturers are seeking alternative materials with comparable performance but lower costs to reduce reliance on copper.

- Supply Chain Optimization: Streamlining supply chains can help minimize overall expenses and offset rising material costs.

- Long-Term Contracts: Negotiating long-term, fixed-price contracts with copper suppliers can provide price stability and predictability.

- Recycling Initiatives: Supporting recycling programs that recover copper from old cars and electronics can create a more sustainable and cost-effective source of this essential metal.

However, several factors could temper the anticipated surge in copper demand. Advancements in material science may lead to the development of viable copper substitutes, while economic downturns or shifts in consumer preferences away from EVs could curb demand. Additionally, improvements in recycling technologies could provide a reliable secondary source of copper, easing pressure on primary production.

While the EV market’s growth is undeniable, it is not yet robust enough to single-handedly sustain the upward trajectory of copper prices. EV adoption rates remain relatively low due to high initial costs and inadequate charging infrastructure. Overcoming these obstacles is crucial for the EV market to become a dominant force in driving copper demand.

Meanwhile, the recent reopening of the Baltimore port, a major hub for vehicle imports, following a temporary shutdown due to a bridge collapse, offers relief to the U.S. automotive industry. The resumption of operations will ease logistical challenges, reduce costs associated with rerouting shipments, and stabilize supply chains. This should lead to improved efficiency, lower prices for manufacturers, and ultimately, better fulfillment of market demand.

MOST READ | Mercedes Advances Sustainability with TSR in ‘Urban Mining’ Collaboration