The Society of Motor Manufacturers and Traders (SMMT), amid looming EV tariff threats, together with EU auto industry advocates, emphatically calls for decisive intervention to sidestep debilitating Brexit tariffs on electrified vehicles. Their unified appeal, imbued with a sense of urgent necessity, resounds with a call for an immediate postponement of the new, stringent Rules of Origin (ROO) concerning batteries. Such looming regulations ominously forecast a shadow of uncompetitiveness over EU and UK-produced electrified vehicles, jeopardizing their standing in their respective markets.

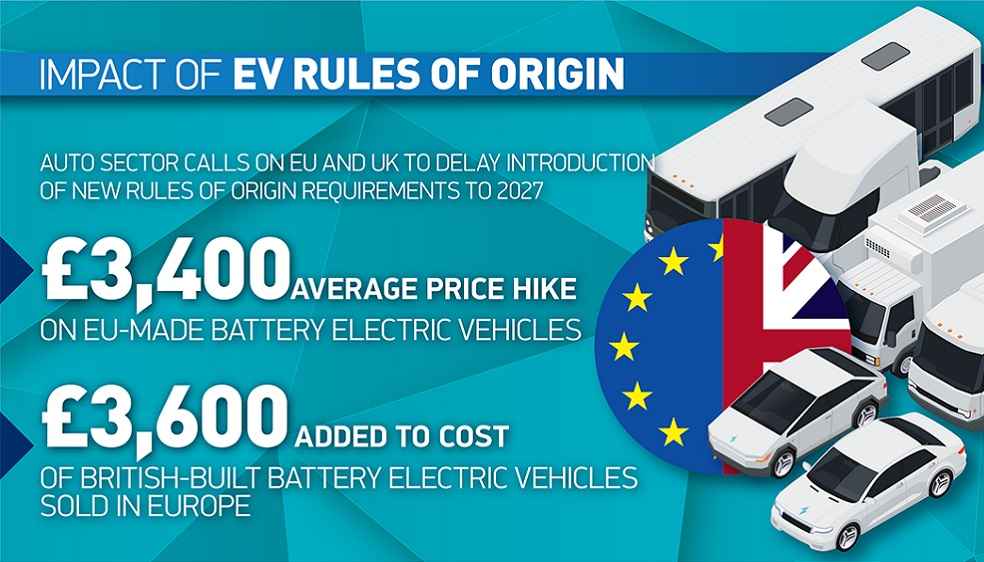

New insights reveal alarming repercussions should the proposed ROO be enacted on 1 January 2024 as per the EU-UK Brexit accord. Vehicles falling short of the revised standards will bear the brunt of a 10% tariff, translating to a cumulative financial burden of £4.3 billion. This tariff imposition signifies a potential escalation in the cost to consumers, marking up EU and UK-manufactured battery electric vehicles (BEVs) by an average of £3,400 and £3,600 respectively.

Navigating through the storm of adversities such as the pandemic and semiconductor scarcities, the EU-UK electrified vehicle trade has managed to flourish. Witnessing a surge, the sector saw a 104% growth since the inception of the EU-UK Trade and Cooperation Agreement (TCA), escalating from £7.4 billion in 2020 to an extraordinary £15.3 billion in the preceding year.

Now, the specter of imminent regulations, slated for introduction in a matter of 75 days, threatens to undermine this robust growth. These preordained directives, conceived before the onslaught of unprecedented global upheavals like the pandemic and the Ukraine conflict, pose a substantial risk to the industry’s vibrancy. An augmented tariff could precipitate a downturn in the industry, eroding the competitive edge of electrified vehicles.

The proposed 10% tariff uniquely targets electrified vehicles, paradoxically fuelling a preference for conventional fossil fuel-powered counterparts. This skewed incentive framework runs counter to sustainable, net-zero objectives, potentially narrowing consumer choices and pushing groundbreaking electrified models to the brink of market extinction.

Mike Hawes, SMMT’s Chief Executive, echoes the pressing necessity for a pragmatic recalibration. Advocating for a three-year hiatus in the ROO’s enactment, he envisages this grace period as a crucial juncture for the organic evolution of EU and UK gigafactories, and the consolidation of intrinsic battery components and essential mineral supply chains. Highlighting the sector’s pivotal role, Hawes remarked, “UK Automotive is a trading powerhouse delivering billions to the British economy, exporting vehicles and parts around the world, creating high-value jobs, and driving growth nationwide.”

A strategic, synergized EU-UK approach, fortified by a shared vision, stands as a cornerstone for nurturing industrial resilience and pioneering a transformative trajectory towards a sustainable, zero-emission automotive landscape.

DON’T MISS | UAW Strike Crisis: $7.7B Blow Rocks US Auto Titans