The European auto industry, renowned for its iconic brands like Volkswagen, BMW, Mercedes-Benz, and Porsche, is teetering on the brink of upheaval. With over 800,000 direct jobs hinging on these automotive giants, the looming threat of electric vehicles (EVs) poses a question of survival.

The catalyst for this impending crisis is twofold: Europe’s late entry into the EV revolution and China’s aggressive strategies. The Chinese auto industry has managed to secure control over essential resources such as cobalt, a critical component in car batteries, leaving European automakers in a vulnerable position.

German auto manufacturers, traditionally reliant on highly profitable diesel technology, are now hastily pivoting towards EVs. However, China and the U.S., having embraced EVs much earlier, have a significant head start. Tesla, for instance, has been producing battery-powered cars since 2008 and boasts a market value over seven times that of Volkswagen.

The 2015 Dieselgate scandal, where Volkswagen admitted to rigging diesel engines for false environmental test readings, expedited the German industry’s shift away from fossil fuels. This shift has been further accelerated by the European Union’s “Fit for 55” target, which mandates a 55% reduction in greenhouse gas emissions by 2030 and a ban on new fossil fuel-powered vehicles by 2035.

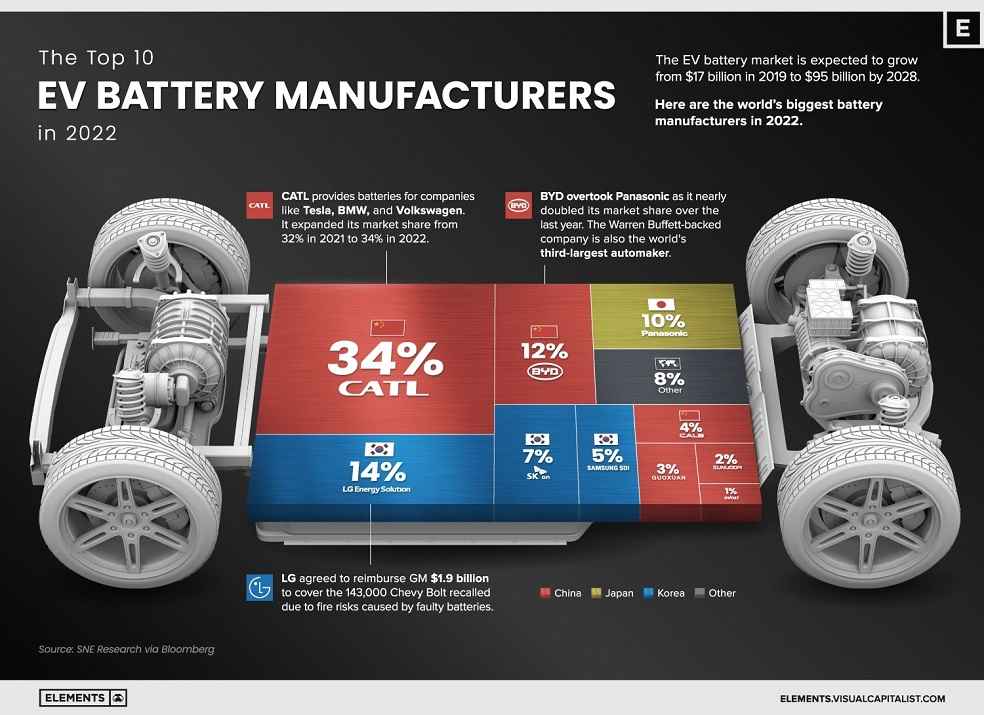

These policy changes inadvertently handed a significant advantage to China, whose share of the global EV battery market reached over 60% in 2022, according to SNE Research. Moreover, China’s CATL has emerged as the world’s largest EV battery maker, controlling over a third of the global market. By 2025, it is projected that China will control half the global cobalt market.

The implications for European automakers are dire. With a dozen years left to reinvent themselves as zero-emission car manufacturers, they face the daunting challenge of catching up with China and Tesla. As EVs become more prevalent and cost-effective, European consumers will likely opt for cheaper models, leaving European automakers to cling to the luxury EV market segment.

In conclusion, the battle for EV dominance may push European governments to subsidize their native car manufacturers extensively, forcing taxpayers to shoulder the burden of a transition hastened by stringent emission reduction goals. The next decade will truly test the resilience and adaptability of Europe’s prestigious auto industry

SPECIAL STORY: Surge in GCC Electric Vehicle Market: A Promising Future Ahead